Successful M&A partnership strategies are built on three critical factors:

1. Determine the current status of the company.

Is your company contemplating strategic expansion? Start by looking at your company’s goals and objectives. Make sure to undertake an ESG analysis in order to gain a better grasp of your operational context. ESG is a framework for examining trends and the amount to which a corporation works for societal goals that extends beyond the organization’s basic duty of profit maximization for its shareholders, which is the fundamental goal of ESG.

2. Identify the areas in which it doesn’t have the necessary capabilities.

Second, companies should identify and pick targets that are in line with their strategic goals. The first step is to identify your company’s strengths and shortcomings in areas where demand is on the rise.

3. The company should explain how M & A will help it compete.

If a company’s transition opportunity exists, consider how to finance and sell it, as well as how to get capital for it from investors. Each phase of a company’s M&A integration should include a detailed action plan, replete with milestones. With these safeguards in place, every company contemplating an M&A collaboration will know exactly what to expect.

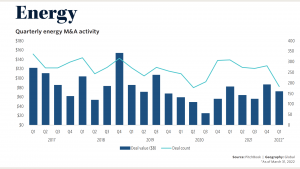

SIRIUS HAS BEEN HELPING SUPPORT TRANSACTIONS IN THE ENERGY SECTOR SINCE 1998.

We focus on these four key areas:

Sirius Solutions has been serving the energy space since inception almost 25 years ago, and has supported the energy sector through multiple downturns throughout the 1990’s and 2000’s.

Sirius has expertise serving clients in all the subsectors including:

- Upstream

- Downstream

- Midstream

- Alternative Energy

We provide Transition Services that you can rely on while mitigating risk as we plan a transition or carve-out that results in a sustainable operating model. No matter what stage you’re at or how many questions you have, our skilled professionals give hands-on assistance from start to end.

Our Areas of Expertise in Transition Services include:

- Negotiation & structuring of transition service agreements

- Transition planning

- Day 1 readiness planning & execution Roadmaps

- Cash settlement & establishing treasury management

- Data migration & cleansing

- System selection & implementation

- Organizational design & establishment

- Interim operations to insourced or outsourced functions

As former industry senior executives and trained professionals, our teams are performance focused and understand the complexities, nature and timing of our clients’ unique business challenges

At Sirius Solutions, we tailor solutions for individual clients. We are guided by a philosophy that ensures our clients get the requisite value needed in post-transition. We are proud of our consistent outcomes in our transition processes due to our experience and understanding. Check out just a couple of our success stories below:

Success Stories

Finance And Accounting Organization Creates Scale for Growth

Concerned that their business strategies would double the organization’s cost, we provided recommendations on strategic vs. non-strategic areas to focus on, thereby creating scale for business growth.

An Independent Exploration and Production company Becomes SEC-compliant after Merger on a Budget

After a successful merger, the client lacked the resources needed to be SEC-compliant on a budget. We worked with the company efficiently on the required timelines, setting them up for future success.